how to declare mileage on taxes

6 hours agoAmid a debate on the ethical issues surrounding moonlighting income-tax authorities have raised concerns about its tax implications for those who take up additional. Of course the IRS isnt going to take your word for it.

Irs Raises 2022 Standard Mileage Tax Deduction Rates To Cover Higher Gas Prices

By Feb 28 2022.

.png)

. What are the standard mileage tax deduction rates. You must file a tax return if you have net earnings from self-employment of 400 or more. You must file a tax return if you have net earnings from self-employment of 400 or more from gig work even if its a side job part-time or temporary.

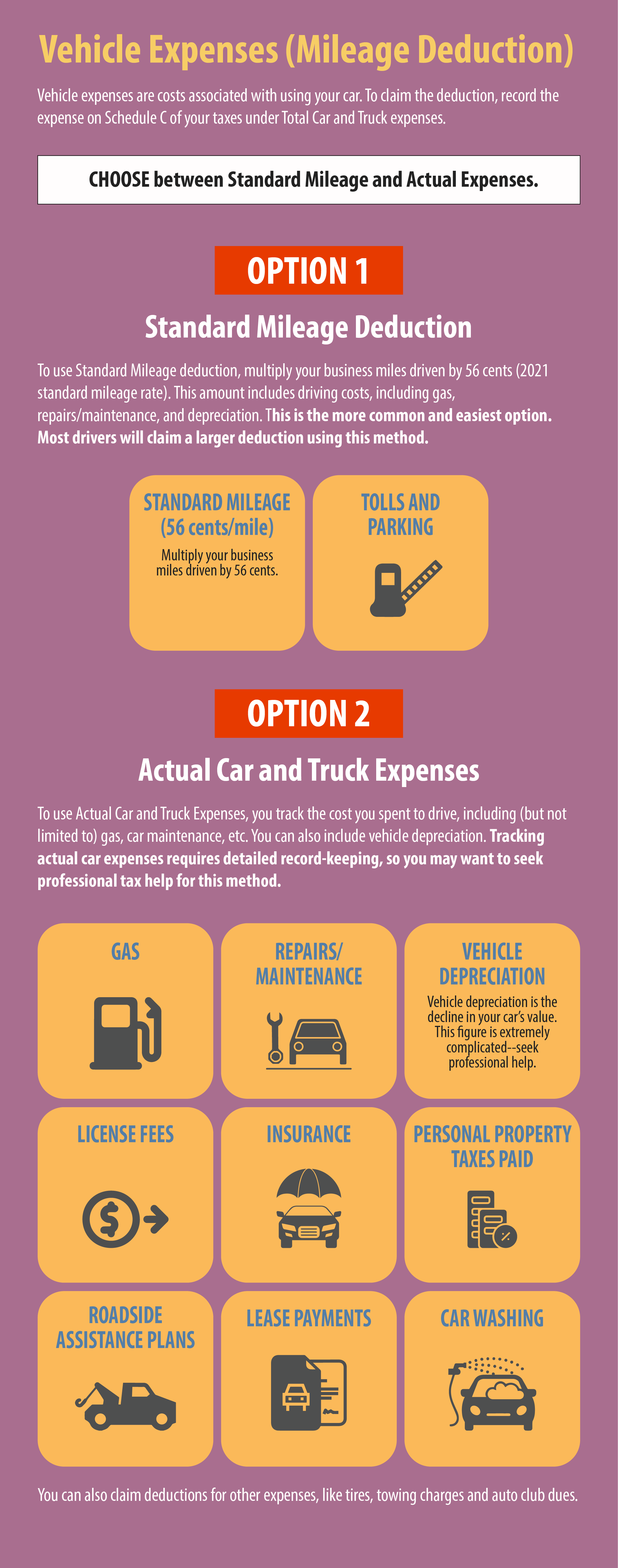

All car Dashers in. The standard IRS mileage rate for the 2021 tax. Calculating your standard mileage deduction.

Taxes or fees not paid. 15000 income - 5000 loss 10000 business income. Tax reports filed with no payment when payment is owed.

If you used your. For 2022 the standard mileage rates are. You must pay tax on income you earn from.

How To Declare Taxes As An Independent Consultant Sapling Jamberry Business Lularoe Business Thirty One Business. How To Declare Taxes As An Independent Consultant Sapling Business Mileage Lularoe Business Business Tax. Here are the five steps youll need to take to claim mileage on your taxes.

The total business miles travelled by an employee is 11500. That means the mileage deduction in 2022 2021 rate is different from previous years. Distinguishing between a hobby and a business is.

All car Dashers in the US that are eligible for 1099 in 2021. 625 cents per mile for business 585 cents Jan-June 2022 22 cents per mile for medical 18. The IRS sets a standard mileage reimbursement rate.

Rates per business mile. Choose your method of calculation. Dasher mileage will be emailed out to all Dashers in the following order.

What Are The 2021 2022 Irs Mileage Rates Bench. The employer reimburses at 15p. Deduct your mileage expense to lower your taxable income.

For instance lets say you drive 12000 miles in a. For 2017 you can claim. A taxable income of 15000 from a landscaping business.

You can use these rates to calculate your tax deduction at the end of the year. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p plus 2000 x 25p. The maximum claim is 10000 miles at 45p and 1500 at 25p for a total of 4875.

Tax reports not filed. The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. You will need to choose either the actual expense method.

Tax reports filed with zero mileage and zero tax paid but operations were observed.

How To Claim The Standard Mileage Deduction Get It Back

Can I Claim Mileage On My Taxes

How To Claim Mileage On Taxes In The U S Freshbooks Blog

How To Claim The Standard Mileage Deduction Get It Back

About Your Odometer And Your 12 000 Tax Deduction Mileagewise

How To Claim Mileage On Taxes In The U S Freshbooks Blog

21 Essential Small Business Tax Deductions And How To Claim Them Architectural Digest

Mileage Vs Actual Expenses Which Method Is Best For Me

Everything You Need To Know About Claiming A Mileage Tax Deduction

How To Claim Mileage On Taxes In The U S Freshbooks Blog

Irs Mileage Reimbursement 2022 Everything You Need To Know About

Taking A Self Employed Mileage Deduction After Reimbursement Mileiq

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

How To Claim The Standard Mileage Deduction Get It Back

How To File Taxes As An Independent Contractor Everlance

What Is Hmrc Mileage Claim Tax Relief Policy A Guide

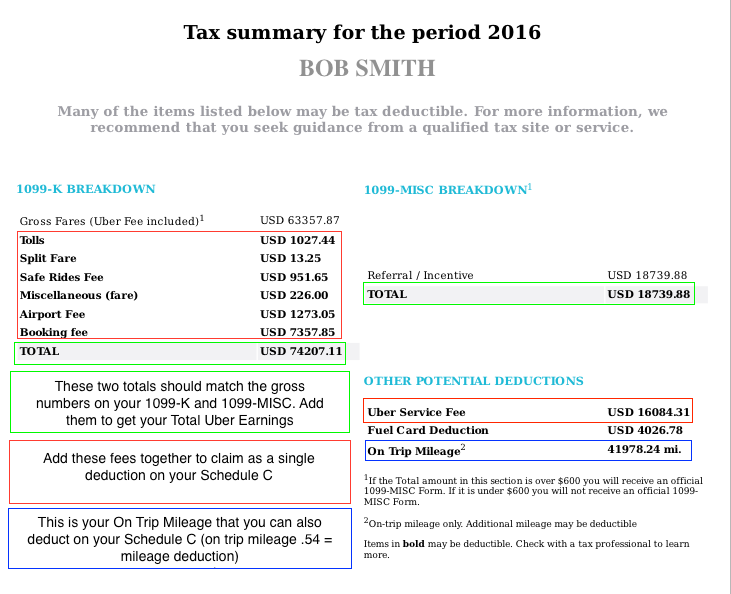

Top 7 Mistakes That Rideshare Drivers Make At Tax Time Stride Blog

Business Mileage Deduction 101 How To Calculate For Taxes

Tax Deductions For Rideshare Uber And Lyft Drivers And Food Couriers Get It Back