georgia estate tax exemption 2020

The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents.

Estate Tax Rates Forms For 2022 State By State Table

The Internal Revenue Service announced today the official estate and.

. It was approved. Complete Edit or Print Tax Forms Instantly. Regarding taxation in the State of Georgia is the 10200.

Share to Twitter. The home is our legal residence wherein we live full-time and - Answered by a verified Real Estate Lawyer. Exemption of Certain Instruments Deeds or Writings From Real Estate Transfer Tax.

2021 List of Sales and Use Tax Exemptions. Due to the high limit many estates are exempt from estate taxes. Government would need to dramatically reduce these taxes for the changes to have any significant effect.

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office. When applying for the ohio homestead exemption for taxes due in 2020. Before assuming that an estate is exempt it is critically important to analyze the estate because many assets such as life.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. 2020 Georgia Code Title 48 - Revenue and Taxation Chapter 6 - Taxation of Intangibles Article 1 - Real Estate Transfer Tax 48-6-2. Exemption10000 Your Georgia Taxable Income is less than 10000 Your GA Income Tax Return Form 500 See line 15 for 2018 or Line 15C for 2019.

Before sharing sensitive or personal information make sure youre on an official state website. Generally senior exemptions in Georgia are aimed toward lowering the property tax burden instead of incentivizing migr ation. Download and save the form to your local computer.

The Atlanta Georgia Property Tax Homestead Exemption was on the ballot as a referral in Atlanta on November 3 2020. A yes vote supported exempting from property taxes property owned by a. To save the file right-click and choose save link as.

Below is a summary of the 2020 figures. As of July 1st 2014 OCGA. For 2020 the estate tax exemption is set.

For Effective Date See note Property Exempt From Taxation 48-5-411. All Major Categories Covered. The GDVS can only verify the status of a.

TurboTax Home Biz Windows. Does Georgia have an estate tax. Georgia Tax Center Help Individual Income Taxes Register New Business.

Under federal tax law estates with fewer than approximately 5 million in assets are not subject to estate taxes. The Georgia Net Income requirement used for determination of eligibility is a not a number found on income tax forms but a formula provided by the Georgia Department of Revenue. These figures are adjusted annually for cost-of-living increases.

I know that states have specific requirements that must appear in the deed to preserve homestead. - Exemption of part of building or part of its value for taxation 159 ALR. HOW DO HOMESTEAD EXEMPTIONS REDUCE PROPERTY TAXES.

Requirement That Consideration Be Shown. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount. For tax year 2020 the first 10200 of unemployment income was exempt from Federal tax.

This exemption must be applied for in person. 48-12-1 was added to read as follows. A yes vote supported authorizing a 30000 property tax exemption for homes located on community land trusts defined as property subject to a lease of not less than 99 years to 501 c 3 non-profit landlord.

The current exemption for all three of these taxes is the same at 117 million in 2021. Federal estate tax largely tamed. Select Popular Legal Forms Packages of Any Category.

A On and after July 1 2014 there shall be no estate taxes levied by the state and no estate tax returns shall be required by the. The Tax Cuts and Jobs Act signed into law in 2017 doubled the exemption for the federal estate tax and indexed that exemption to inflation. Each property is appraised at Fair Market Value.

Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences. Prior taxable years not applicable. Ad Complete Tax Forms Online or Print Official Tax Documents.

Tax exemption of real property as affected by time of acquisition of title by private owner entitled to exemption 54 ALR2d 996. A similar study shows that an increase in property taxes does lead to a rise in senior migr ation. To successfully complete the form you must download and use the current version of Adobe Acrobat Reader.

For 2020 up to 36132 for an. It was approved. The estate and gift tax exemption for 2021 is 117 million.

The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts for estate gift and generation-skipping transfer GST taxes. Local state and federal government websites often end in gov. To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter.

The higher exemption will expire Dec. Estate Tax - FAQ. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attrorney Forms.

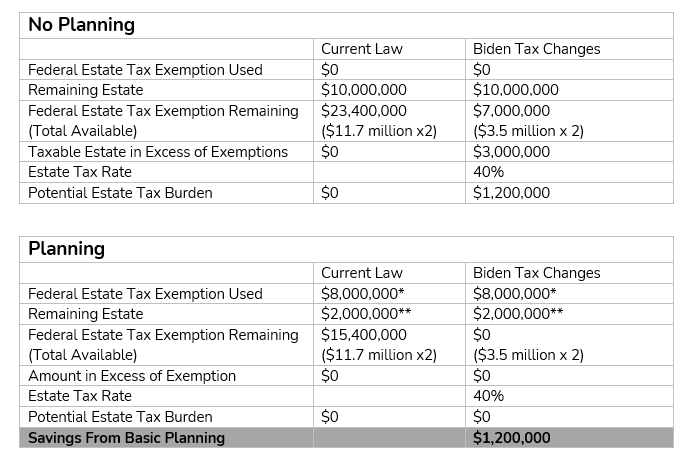

2020 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax Exemptions and Deferral Part 1 - Tax Exemptions 48-5-40. There are Democrat proposals to reduce the estate and GST tax exemption from 117 million to 35 million. Georgia law is similar to federal law.

2020 HOMESTEAD EXEMPTION DEADLINE WEDNESDAY APRIL 1 2020. Georgia Referendum A Property Tax Exemption for Certain Charities Measure 2020 Georgia Referendum A the Property Tax Exemption for Certain Charities Measure was on the ballot in Georgia as a legislatively referred state statute on November 3 2020. Up to 15 cash back Our Homestead Exemption was denied by County Georgia.

2020 Georgia Code Title 48 - Revenue and Taxation Chapter 5 - Ad Valorem Taxation of Property Article 2 - Property Tax. Exemption of Qualified Farm Products and Harvested Agricultural. Assessments assigned to the property sanitation stormwater or streetlights etc.

2021 - 501 Fiduciary Income Tax Return 2020 - 501 Fiduciary Income Tax Return Prior Years - 2019 and earlier. Justia Free Databases of US Laws Codes Statutes. Elimination of estate taxes and returns.

Exempt from Georgia tax. Or taxable by Georgia. Get Access to the Largest Online Library of Legal Forms for Any State.

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

What You Need To Know About Georgia Inheritance Tax

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Recent Changes To Estate Tax Law What S New For 2019

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2021 A Look Ahead At Georgia Estate Planning Brian Douglas Law

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Are Your Clients Subject To Massive Estate Taxes Without Knowing It Everplans

Estate Tax Should Target The Wealthy Not Middle Class Lowell Sun

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What You Need To Know About Georgia Inheritance Tax

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition